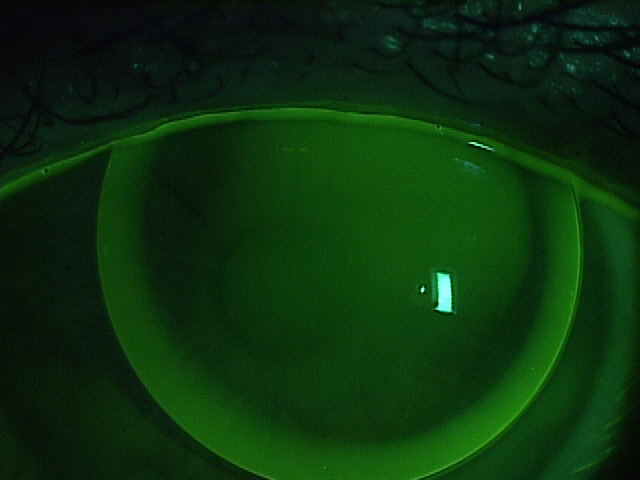

The Gas-Permeable Contact Lens

The mainstay of treatment for our patients with keratoconus are gas-permeable lenses. Corneal gas-permeable (GP) lenses have been the treatment of choice for over 40 years and fit approximately two-thirds the size of the cornea. Corneal GP lenses translate and pump tears and oxygen under the lens with each blink. Hybrid lenses have a GP center bonded to a soft skirt that cushions and centers the lens. Scleral lenses are very large diameter lenses that completely vault the cornea and land on the relatively insensitive scleral tissue. Whether they are corneal GP, hybrid, or scleral lenses, the commonality is that all of these strategies use the optics and rigidity of GP materials to provide the best vision and comfort for this challenging condition.

The way that the GP industry works is that GP button manufacturers (there are 6 in the US) sell the raw material, or button, to independent laboratories (there are 39 in the US) who then craft the button using industrial lathes into hundreds of lens designs using their own intellectual property. GP buttons are used to make corneal GPs, hybrid, and scleral lenses. Doctors who are skilled in fitting and evaluating the lens designs craft custom made GP lenses for their patients for whatever purpose benefits the patient.

Not many people know that the GP lens industry is on fire right now. The turmoil began when Valeant Pharmaceuticals purchased Boston Products. Boston Products manufactures the raw material of GP lenses, GP buttons, and held around 80% of the US market share.

The independent laboratories have a trade association called the Contact Lens Manufacturer’s Association (CLMA) who have an educational wing called the Gas-Permeable Lens Institute (GPLI). The GPLI is universally beloved by practitioners because its primary function is to educate doctors to become better doctors in a non-branded, good-of-the-industry format. No lens design is favored over any other. Education is free to all doctors and expertise in specialty lenses is stressed, so that patients are placed in skilled hands. Jan Svochak, president of the CLMA, says, “The CLMA represents a longstanding group of Independent Contact Lens Manufacturers working collaboratively where we have shared goals. These include educational resources through the GPLI that work closely with Eye Care Practitioners and Educational Institutions as well as a dedication to protecting and advancing utilization of custom manufactured contact lenses.”

Next Valeant dropped the hammer on the industry. Overnight and for no apparent reason, they sent a letter to all of the independent laboratories announcing that they were increasing the price on scleral lens-sized Boston buttons by an astounding 60% (and other buttons by multiples). Simultaneously, they announced that they were dropping out of the CLMA. This move stunned the CLMA member labs as it blocked them from supplying Paragon CRT lenses to doctors. Being the market leading GP button manufacturer, dropping out of the CLMA essentially defunded the GPLI and ensured the immanent collapse of the CLMA.

The price increase sent shock waves throughout the industry. There was a simultaneous but independent reaction from many of the key-opinion leading optometrists who fit GP lenses. The problem with any increase in price on the GP button level is that these price increases are passed down the line through the laboratories, the doctors and eventually, to the patients. Valeant saw a huge backlash from optometrists who essentially stopped prescribing their materials. They admitted making a mistake, and lowered the cost of the buttons, but interestingly, not to the original level. Instead, there was an average 16% increase in the cost of scleral lens buttons to the laboratories. Similarly, Valeant did not rejoin the CLMA. The cost increase has been reported to fund Valeant brand specific education.

The other members of the CLMA came together and saved the association and the GPLI. Additionally, a key competitor to Valeant, Contamac, rejoined the CLMA. Contamac is a button manufacturer who formerly held around 8% market share of GP buttons. At present, key sources within the industry believe that the market share has essentially flip-flopped, so that now, Contamac has rapidly gained market share of the GP button space as doctors have largely abandoned Boston materials in protest of these moves.

In a reactionary panic, Valeant has most recently written to the CLMA, asking to rejoin, but paradoxically with demands. The CLMA is currently reviewing whether to allow Valeant to rejoin and under what terms. Long term, it is beneficial for the industry for everyone to work together for the common good. It is unfortunate that a large company has come into the keratoconus treatment area and is raising prices without providing any real value, such as research and development into newer and better tools. Companies like Valeant ultimately need to realize that they are not in control of an industry. The patients and doctors are.

Dr. Sonsino is a partner in a high-end specialty contact lens and anterior segment practice in Nashville, Tennessee. For over 12 years, he was on the faculty at Vanderbilt University Medical Center’s Eye Institute. Dr. Sonsino is a Diplomate in the Cornea, Contact Lens, and Refractive Therapies Section of the American Academy of Optometry (AAO), chair-elect of the Cornea and Contact Lens Section of the American Optometric Association (AOA), a fellow of the Scleral Lens Education Society, board certified by the American Board of Optometry (ABO), and an advisory board member of the Gas Permeable Lens Institute (GPLI). He lectures internationally, publishes in peer-review and non-peer-reviewed publications, and operates the website: TheKeratoconusCenter.org. He consults for Alcon, Art Optical, Allergan, Johnson & Johnson, Optovue, Synergeyes, Visionary Optics, Visioneering, and formerly for Bausch & Lomb.

3/30/16

The Contact Lens Center at Optique Diplomate

Cornea, Contact Lens, and Refractive Therapies,